5 reasons why 2021 will be the year of venture in Norway

Although the past year has been challenging for most industries, the Norwegian startup ecosystem is in better shape than ever. In a decade, the startup scene has gone from being almost nonexistent to a steadily growing crowd of high potential startups.

In this article, we take a closer look at trends affecting the Norwegian venture environment, the impact of the pandemic and why we believe 2021 will be the year of venture capital in Norway.

Norway - the venture laggard?

The Nordics have been on the rise for quite some time.

Although they only account for about 4% of Europe’s total population, 17% of all venture capital is invested here.

For a long time, Norway’s venture capital environment has been rather dormant, compared to its significantly more active Scandinavian neighbors. One of the most important reasons for this is Norway’s petroleum-heavy economy. Locking in both top-tier talents and capital over the past decades, this has created market dynamics that are very dissimilar to the ones in Sweden and Denmark.

Whereas Sweden in particular has fostered a high-performing ecosystem for startups and venture capital, with high profile players such as Northzone, Creandum, - showcasing early investments in Spotify and Klarna among others - Norway has built its wealth upon its plentiful natural resources.

Norway is unquestionably a global player within sectors such as oil and gas, hydroelectric power, shipping and seafood.

This is also clearly denoted in Norway’s venture capital track record. HitecVision, focusing on the North Sea energy sector, has been pretty much alone in the venture space in Norway. They have however been highly successful over the past three decades and currently have USD 5,4 billion under management.

Although Sweden is the forerunner – particularly in terms of transaction size in seed stage – Norway is now quickly catching up; in 2018, the number of seed transactions was equivalent to Sweden’s.

So, how is it that Norway is catching up all of the sudden? An how does the pandemic impact Norway’s nascent venture ecosystem?

Read on to get our take on the effects of Covid-19, and why we believe you should stay tuned to what’s going on with Norway’s venture scene this year.

Covid-19: nipping Norwegian startups in the bud?

The past year has been very unlike any other - for everyone. We could assume that Covid-19 would impede the development of Norways young and promising startup ecosystem.

As it turns out, it’s quite the opposite.

Most startups have been confronted with the difficulty of recruiting new customers due to limitations in physical meetings and a general slow-down in decision making in many larger companies.

However, startups with a software offering and a digital delivery have – not surprisingly - managed well through the crisis. At Norselab, we have several SaaS businesses in the portfolio, and all of them have proven resilient through this period. One example is our prop-tech company Varig who has developed a software for sustainable property management. Despite the pandemic, they signed a deal with one of the leaders in their industry, setting the pace for further growth.

Another of our portfolio companies, Farmable, has experienced a world-class growth rate throughout the period. As they provide farm management software for tree crop growers across the globe, Covid-19 has not affected the demand for their product at all – rather the contrary; The world still craves for more plant-based foods, and farmers need to adapt to less labor-intensive methods.

More generally, the rise of Norwegian technology companies offering services within video conferencing and health (among others) is unquestionable – with companies such as Whereby and Confrere experiencing an unprecedented boost.

Despite the hardships of Covid-19, the ecosystem seems to have continued its stride, producing a steady stream of promising cases in various industries and sectors.

Why 2021 will be the year of venture in Norway

Against this backdrop, let’s not forget that Norway provides a very favorable environment for investments in general. A strong and stable economy with world class industries (think: oil and gas, energy, maritime and seafood), an extremely well-educated workforce, political stability and high degree of transparency creates a solid foundation for attracting investments.

But this is of course not sufficient for venture to thrive. The geographical concentration of VC environments worldwide – most of them based on US territory – only goes to show that you require several well-functioning and mutually reinforcing components to grow a successful ecosystem. This article from The Entrepreneur gives some perspective on the different pieces of the puzzle.

We do however believe that Norway is on the brink of a breakthrough. Norway benefits from an industrial legacy that now meets several new, converging trends. These trends impact the ecosystem very favorably, leaving us feeling very optimistic about the year ahead.

#1 Norway’s high-tech legacy is fostering tomorrow’s successes

Given Norway’s substantial industrial focus, most of Norway’s capital has historically been invested in heavy assets within oil and gas, shipping, rigs and aquaculture installations.

Despite a context with low capital availability for newcomer industries, Norway has - maybe surprisingly to some - also fostered numerous high-tech companies with a global reach, particularly within video conferencing, semiconductors and web technologies. Names such as Tandberg, Pexip, Energy Micro, Chipcon, Fast Search & Transfer, Opera Software and Visma may ring a bell for some readers.

These companies have formed competence clusters across Norway. They prove to be instrumental in fostering the next generation of tech startups within these industries.

#2 The startup scene is flourishing

The grassroots of the Norwegian ecosystem have been rapidly growing both in terms of volume and quality over the past years. Several indicators bear witness of a thriving and ambitious startup community.

Norway now has plenty of pre seed and seed stage players, including high-performing incubators, accelerators, and investors. This has resulted in a vibrant arena that has grown a substantial number of high-potential startups.

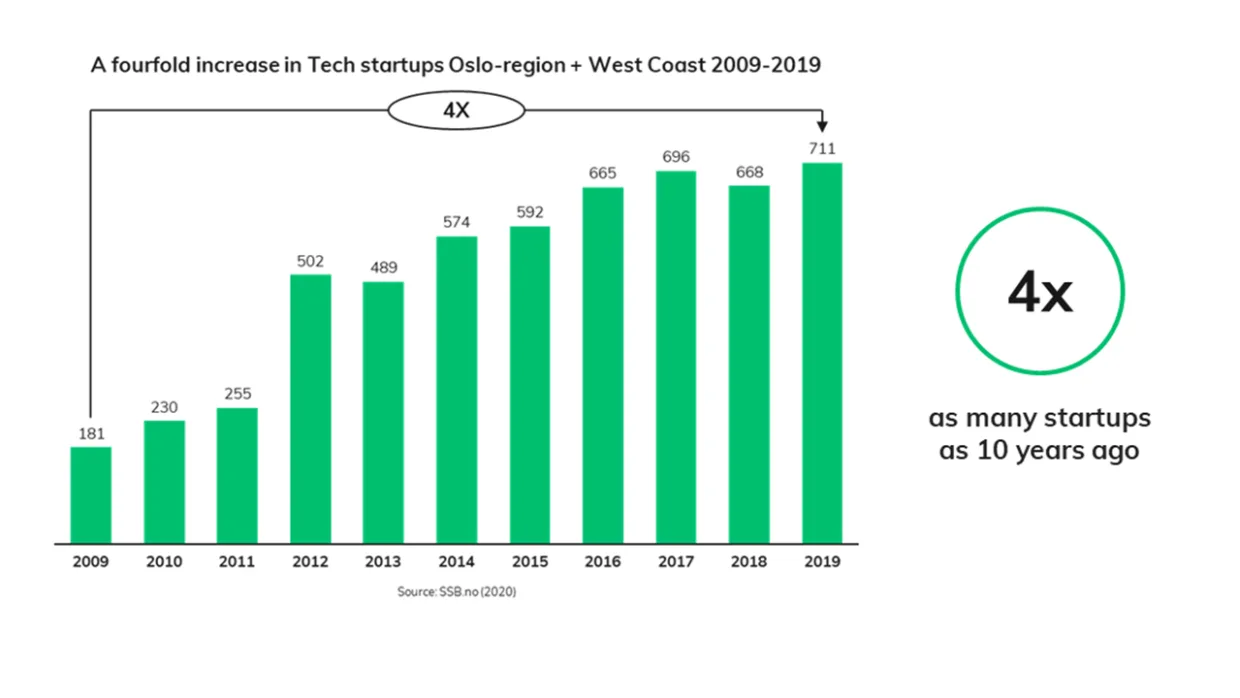

The figure below shows the steady increase in tech startups out of Norway’s leading innovation hubs. In sum, there is a fourfold increase in Norwegian tech startups in just 10 years.

#3 The Green Shift is accelerating

Sustainability defines pretty much everything that’s cooking in Norwegian business nowadays. The time when sustainability was an optionality is long gone, now it’s a license to play. However, many industries will struggle as consumers, businesses and authorities start to expose greenwashing and seek products and companies where sustainability is an integrated part of the core business. The EU taxonomy regulation is on everyone’s lips these days. Our guess is that it will set the new international standard for the until now rather fragmented ESG approach.

In Norway, we have named the ongoing transition “The Green Shift”, and it’s a gamechanger.

The push for a green economy seems even stronger here than most other places. Our oil heritage is still responsible for Norway’s “dirty” economy, and the ambitious goals the government has set call for a profound change.

In the Paris Agreement, Norway commits a 40% reduction in its carbon emissions by 2030, exceeding the European Union’s targets. Early 2020, Norway even announced that they were stepping up the target to 50%. To achieve these goals, Norway is now implementing far-reaching policies - many of which are designed to stimulate development of new, environmentally friendly technologies.

There is now a wide array of means put at the disposal of more sustainable businesses, giving a head start to anyone who seeks to contribute to the effort.

The past year’s oil price volatility, as well as the ongoing pandemic, have only accelerated this movement. Now is definitely a favorable time to build truly sustainable technology companies out of Norway.

#4 Talent bonanza

From our viewpoint, the single most valuable input into a startup is the talent. As Norselab partner and former Olympic champion Aksel Lund Svindal would put it: “If you have a great idea, but a bad team, you don’t stand a chance. On the contrary, if you have a great team, everything becomes possible.”

Talents’ desire to work for companies with purpose is stronger than ever. Today, this mostly translates into a preference for workplaces that contribute to the SDGs in a meaningful way. Now that Norway is downscaling oil and transitioning into a clean economy, world class, tech-savvy talents are freed up, and move into sectors where they can find purposeful work.

The result of this change is that Norway’s startup community now has unprecedented access to top-tier talents. Some of the smartest and most skilled talents available in Norway are turning their back on asset-heavy and polluting industries. They are now on the outlook for meaningful jobs in the startup ecosystem, wanting to contribute to positive change in the world.

#5 The venture segment is up for grabs

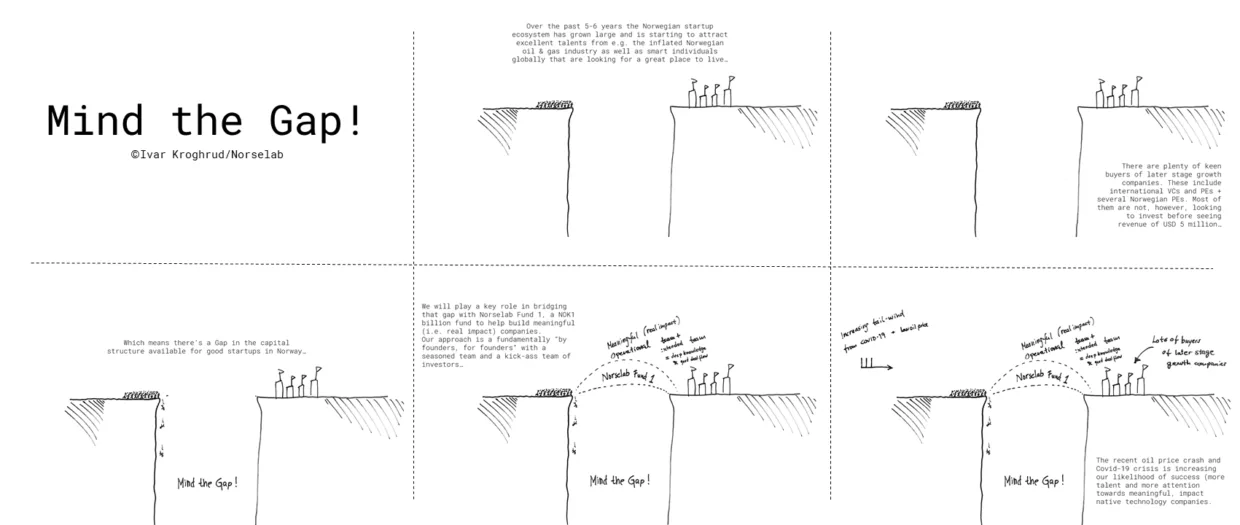

Have you ever heard of “The Growth Gap”?

One of my colleagues, Norselab partner Ivar Kroghrud, explains it quite simply in the below sketches:

The Growth Gap describes a problem we have observed for some time in the Norwegian ecosystem. Raising competent growth capital has been more the exception than the rule for top-notch Norwegian scaleups. Although there is plenty of interest among international VCs and PEs, very few players have been able to help them make it across the growth gap.

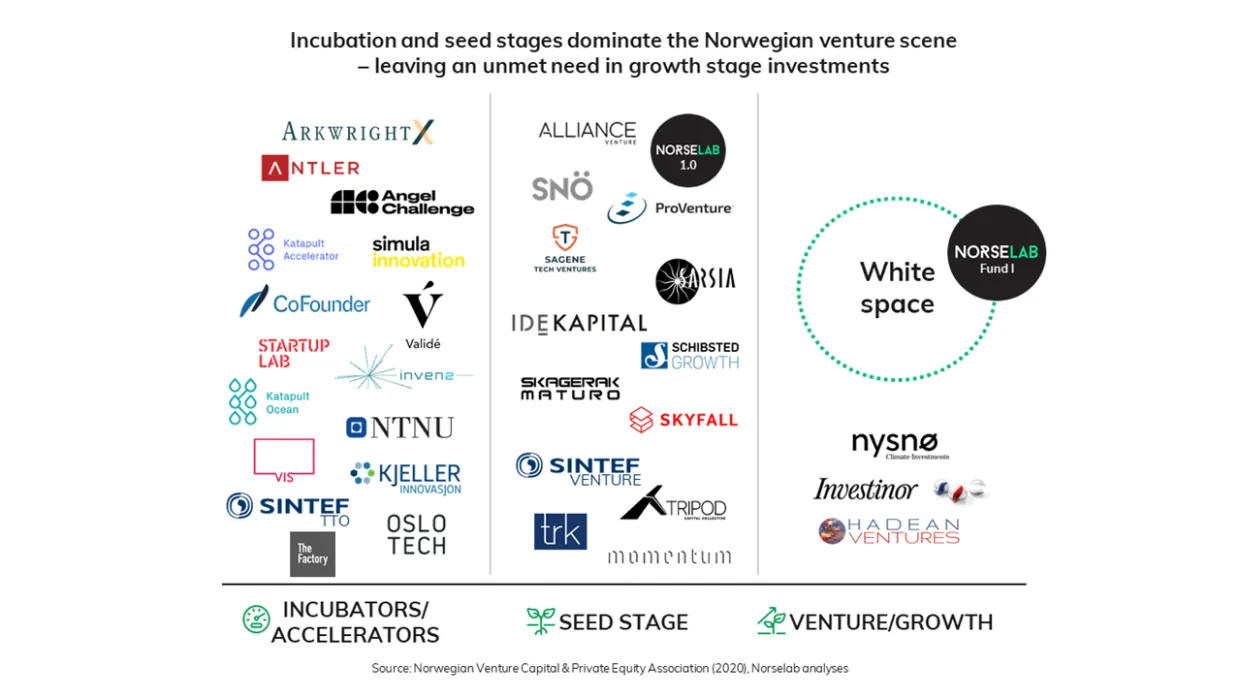

The figure below also shows how the different stages are populated in Norway. Clearly, incubation and seed stages dominate the Norwegian venture scene, as there are few active players in the growth stage. The result being that most high-potential growth cases fall off the cliff, although they showcase the characteristics that venture players look for.

The perfect storm

Without doubt, change is on its way.

We have an ever-growing community, building on a high-tech legacy, that produces more and more high-potential companies. Norway’s push for a clean, green economy makes capital and world-class talent available for the ecosystem. Combined, they show that the lack of players in the venture space is a highly relevant issue.

We need to fill the gap by developing ecosystem players with the competence and capital required to propel the best scaleups towards international success.

We believe that now is the right time to invest in the Norwegian ecosystem. Last autumn, we established a growth fund to fill “The Growth Gap” and capitalize on the favorable developments we are currently observing in Norway.

Several other players have also recently raised funds to move into venture. Moreover, publicly backed players like Nysnø and Investinor have mandates to fuel this trend. Our prediction is that now is just the right time to move into venture, and that the Norwegian ecosystem will significantly improve going forward.

Written by: