Viewpoint: What is impact investing in 2025?

Our impact team takes stock of the state of the field

Impact investing is often described as a fragmented practice lacking shared frameworks and standards. This depiction, however, no longer holds true.

A globally recognized definition

Impact investing has a clear definition. Although there are contrarian views of what impact investing entails, the Global Impact Investing Network’s (GIIN) definition is commonly accepted among leading impact investing organizations worldwide: "Impact investments are investments made with the intention to generate positive, measurable social and/or environmental impact alongside a financial return."

This definition moves beyond the traditional view that profit and impact outcomes are mutually exclusive. Instead, it asserts that capital can be a powerful lever for change while generating competitive financial returns.

Impact investing is often described as a fragmented practice lacking shared frameworks and standards. This depiction, however, no longer holds true.

What “impact investing” entails

With this as a backdrop, let’s establish which practices typically characterize impact investing:

- Intentionality:

Impact investing begins with a clear intention to create positive outcomes. Investors deliberately target specific social or environmental challenges, such as reducing carbon emissions or improving access to education. - Using data and evidence:

Impact investors rely on the best available evidence to understand and enhance the positive effects of their investments. Qualitative and quantitative data can be used to assess and measure impact. - Managing impact:

Impact is tracked throughout the investment lifecycle. Investors also seek to enhance outcomes, often through engagement with investees. This distinguishes impact investing from vague or unevidenced claims of doing good. - Contributing to the industry's growth:

Impact investors are expected to be transparent, use shared terminology and standards, and openly share their insights. This helps others learn and engage, supporting the growth of the impact investing field. - Investor contribution:

True impact investing seeks to create outcomes that wouldn’t happen otherwise. This can happen both through financial and non-financial actions taken by investors. A growing trend, “catalytic investing” shows this in practice: Investors may accept more risk or lower returns in pursuit of filling capital gaps and backing solutions where conventional investors cannot.

Impact investing can take many forms

These elements frame the impact investing practice. However, it can take many different shapes. A common misconception is that impact investing is defined by specific asset types or investment requirements. In reality, impact investing is a strategy that overlays impact objectives onto financial objectives. The impact objective in the strategy defines which assets are fit to achieve the strategy’s objective.

Impact can be achieved through an array of asset classes and instruments. Impact investing is not defined by what you invest in, but why and how. It is a strategy guided by intention and focused on outcomes - it’s not confined to specific assets or sectors.

This makes impact investing a powerful tool for driving positive change across large-scale environmental and social problems. We believe it’s not necessary to prescribe certain asset classes or instruments as long as they serve the intended impact.

Impact and returns - mutually exclusive?

Impact investing is frequently associated with philanthropy—donating money to good causes—and more often with “concessionary returns.” Contrasting this, the lion’s share of impact investors globally seek market-rate returns, and according to GIIN research, they also achieve them.

So, when asking what impact investing is in 2025, we can confidently state that it does not inherently sacrifice financial performance for the sake of doing good. On the contrary, impact investing strategies are more likely to seek market-rate returns.

The ESG-impact conflation

In these times of ESG backlash, particularly virulent in the US, it is important to clarify how impact investing differs from traditional ESG investments. In fact, impact investing is not, and has never been, the same thing as “ESG investing.”

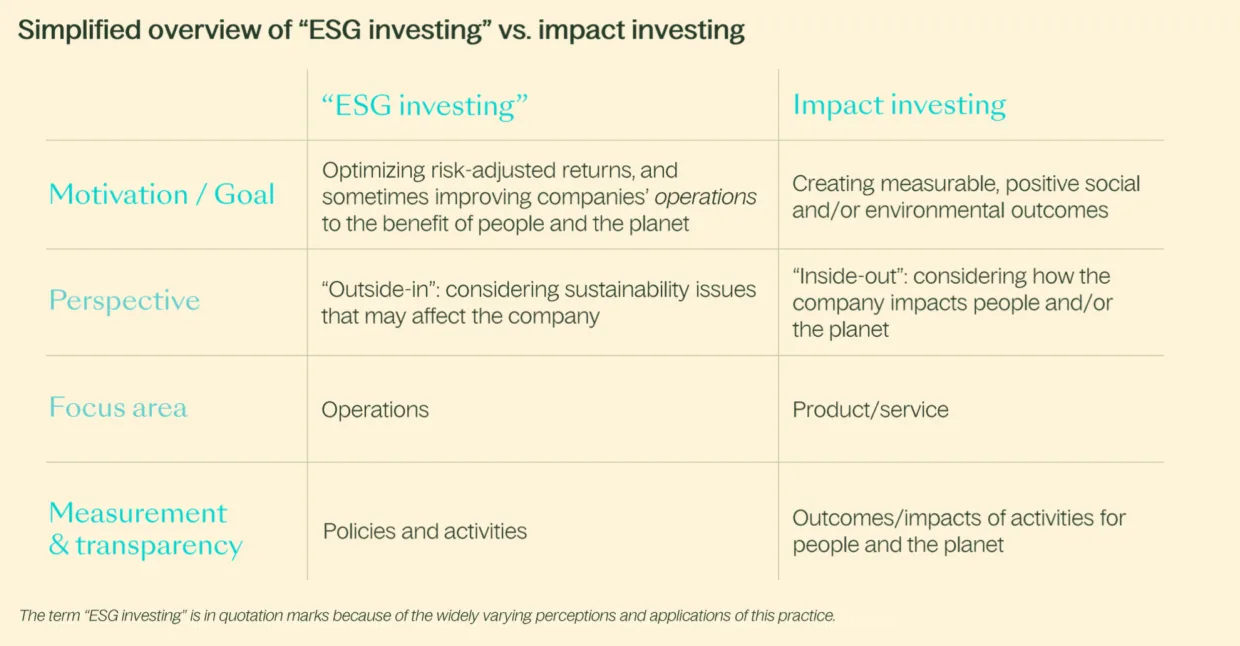

While ESG typically focuses on risk management, avoiding harm, or operational improvements (mainly with financial motives), impact investing is about investing in solutions: in products and services designed to create specific social or environmental results.

Above is a simplified overview of main distinctions between “ESG investing” and “impact investing.” The overview is adapted from NorNAB’s guide to impact investing, which Norselab co-authored in 2024.

A paradigm shift

At Norselab, we view impact investing as a paradigm shift in how capital can be used to create meaningful change. Impact investing holds investments to a higher standard. It is a practice that requires the same skills as conventional investing, alongside a deep understanding of sustainability challenges and how they can be solved in a commercially attractive way.

Here, financial performance and real-world outcomes are not competing — they are collaborating. We believe that the most valuable companies of the future will be those solving humanity's most urgent problems. We believe that, by investing in them, we can also achieve superior returns.

This piece was originally published in our 2024 Meaningfulness Report.

Read the full report