Learn about our impact philosophy and how we make sure the companies we invest in have a real-world, positive footprint.

Our approach to impact

When we consider potential investments, the company’s potential for large-scale, net positive impact is a key criteria. For all our funds, a green light on impact is a prerequisite for any investment.

“Impact” is a many-faceted term. Many consider “impact investing” as an extension of philanthropy. However, impact investments are generally defined as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return” (GIIN).

Norselab's approach to impact investing follows this definition. However, we like to take it one step further; To us, profit and impact go hand in hand. Given the state of our world and current megatrends, the best long-term returns will be generated by companies that contribute to fighting climate change, protecting nature and creating a world of equal changes. We invest in impact companies believing that they will also generate superior long-term returns.

Aiming for net positive impact also means that we go beyond the traditional ESG approach. Our approach is uncompromisingly based on the impact potential of products and services. Although most companies generate some positive effects, many fail to consider the negative effects of their activities, and, in particular, the revenue-generating products and services. Our belief is that a company will only be beneficial for people and the planet if the positive effects outweigh the negative, not only in their operational aspects but across all activities and all dimensions of sustainability defined by the SDGs. This is what we mean when we say we look for net positive impact.

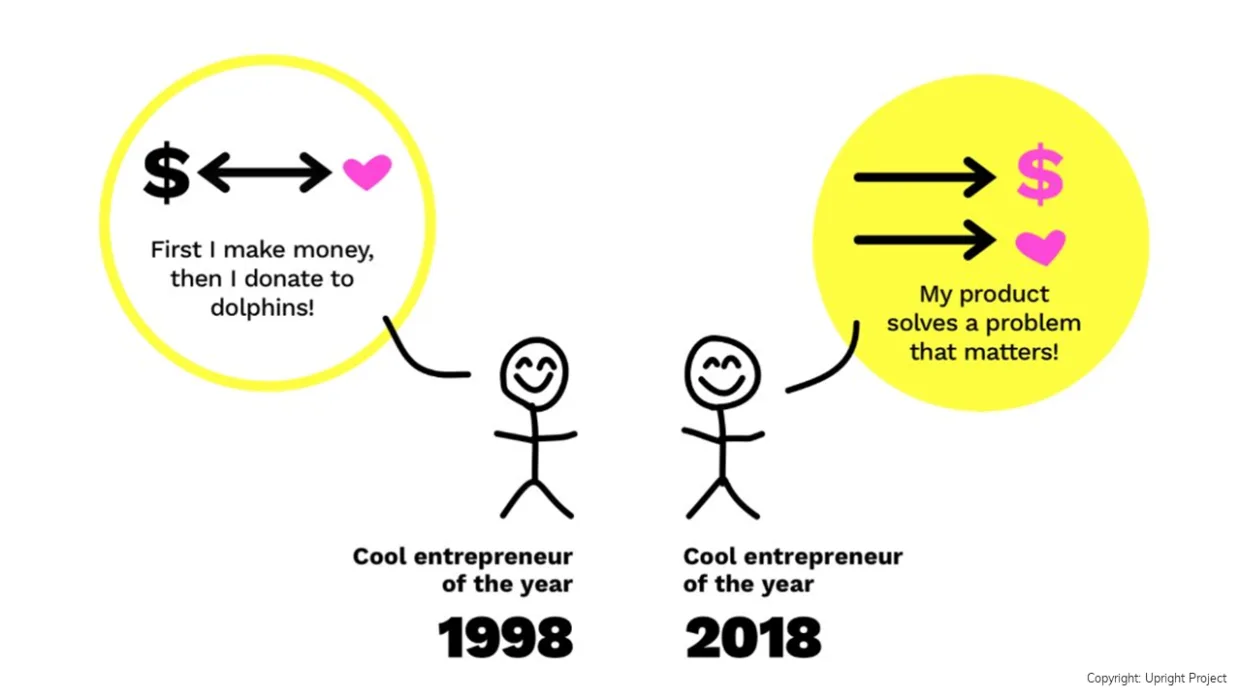

This approach requires us to look at the integration of sustainability objectives in the company’s products and services. We look beyond the marginal things; whether employees walk or drive to work, or whether emissions from business travel are offset. We look at the big things; how a company makes money. We look for products and service offerings that are sustainable per see; produces and services that drive more impact with every new customer or user. Then, there is no retrofitting of impact - impact native companies make their core business about impact. We like to call such companies “impact native”.

Check out our portfolio to learn more about the companies that have already made the cut.

A dedicated policy

Norselab has a dedicated Meaningfulness policy that outlines our impact philosophy. The policy outlines the principles to which we hold ourselves accountable, and which all stakeholders can expect us to respect and fulfill.

The policy includes internationally recognized frameworks that form a solid foundation for responsible investments. We adhere to the ethical principles of the UN Global Compact in the areas of Human Rights, Labour, Environment and Anti-Corruption and subscribe to the UN’s Principles for Responsible Investment. To us, they are a given for any investor claiming to invest responsibly. Norselab is also a certified B Corporation™.

We also use the Sustainable Development Goals as a strategic framework for considering the positive impacts of our investments. This means that our impact approach is not limited to climate change or social aspects - we consider the whole range of focus areas, including impact related to e.g. “Decent work and economic growth” (SDG 8), “Industry, Innovation, and Infrastructure” (SDG 9), “Responsible consumption and production” (SDG12), to mention some. We believe that it’s our responsibility as investors to contribute to this globally recognized roadmap for sustainable development and economic growth.

The full ten principles of our policy can be found here.

How we measure impact

We care particularly about holding our portfolio companies accountable by their impact indicators just as much as by their financial indicators. Also, we think it’s particularly important to use best-in-class measuring tools that match with our impact philosophy.

This is why we have chosen to collaborate with Upright Project on measuring net impact. This Finnish tech company has built an AI-enabled quantification model for investors to measure the net impact of companies. Very much like Norselab, their model focuses on the products and services of companies when calculating the sum of their positive and negative impacts.

While the traditional ESG approach aims to describe how companies conduct their business and comply with certain standards, net impact is the sum of a company’s positive and negative impacts on people, planet, society and knowledge.

For Norselab, this provides a method for consistent measuring of impact across screening, due diligence, follow-up and reporting. The very first net impact analysis of our portfolio will be made available in our Meaningfulness report on our website by this May.