Sustainability-related disclosures

Norselab Meaningful Equity I

LEI: 635400CAD1GUYI7TID29

MEI and MEII were combined into a single fund effective Q3 2024, therefore the relevant SFDR disclosures for both have been made available on this page. The pre-contractual disclosures on this page are applicable for the combined fund.

Download Website Sustainability-related Product Disclosure MEI

Download Pre-Contractual Disclosure MEI

Download 2024 PAI Statement MEII

Download 2023 PAI Statement MEII

Download 2024 PAI Statement MEI

Download 2023 PAI Statement MEI

Download 2024 Periodic Disclosure MEII

Download 2023 Periodic Disclosure MEII

Download 2024 Periodic Disclosure MEI

Download 2023 Periodic Disclosure MEI

Summary

This document aims to provide information on the sustainable investment objective of Norselab Meaningful Equity I (“the fund”), and how the objective is attained. The fund aims to invest in companies whose revenue-generating products or services generate a net positive contribution, through their core products and services, to the UN Sustainable Development Goals (the "UN SDGs"). The fund aligns with Norselab’s proprietary impact philosophy, “Meaningfulness”. as well as Norselab’s “Meaningfulness policy”. We follow a structured assessment process to identify the company’s positive contribution(s) to the SDGs in line with the fund’s objective. The assessment process also seeks to uncover any significant harm to the sustainable investment objective. As an active owner, Norselab follows up with portfolio companies regularly on sustainability topics and works proactively to enhance contribution to the SDGs, as well as implement relevant measuring and reporting schemes for impact.

No significant harm to the sustainable investment objective

All portfolio companies undergo an impact due diligence that aims to uncover any significant harm to the sustainable investment objective. This includes assessing that:

- Products or services of portfolio companies do not have a significant negative impact on any of the SDGs.

- Portfolio companies do not cause significant Principal Adverse Impacts benchmarked against industry peers.

- There are no known good governance issues concerning the portfolio company.

- There are no known issues or risks related to the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights.

Sustainable investment objective of the financial product

The fund aims to invest in companies whose revenue-generating products or services create a net positive impact on people and/or the planet, and align with one or several of the SDGs. The SDGs are a globally recognized framework for designing a future where economic growth does not compromise the safekeeping of the environment and the well-being of people and societies.

The fund aligns with Norselab’s proprietary impact philosophy, “Meaningfulness”, as well as Norselab’s “Meaningfulness policy”. The policy describes Norselab’s 10 principles for meaningful investments. It includes using the SDGs as a strategic framework to create a positive impact, adopting long-term investment perspectives, taking active ownership through engagement with companies, and committing portfolio companies to comply with all applicable laws and regulations as well as the ethical principles of the UN Global Compact.

Meaningfulness is built on three core pillars that describe the characteristics of the companies the fund will invest in:

- Product-driven impact: creating positive impacts through their revenue-generating products and services.

- Net-positive impact: accounting both for the negative and the positive effects of a company.

- Impact where it matters: backing companies that accelerate the sustainable transition of their industries.

The fund aims to invest primarily within the following impact themes:

- Energy transition: investments that contribute to tackling climate change.

- A circular world: investments that contribute to making the most of every resource.

- Sustainable food systems: investments that help close the food gap while protecting the environment.

Investment strategy

The fund will primarily allocate capital investments in companies that are identified based on two main theses, which define the investment focus for the fund.

- Companies with superior growth potential: we target companies identified as having potential for rapid growth. Typically, the products of such companies have proven their value to several customers, indicating forthcoming readiness for international scaling

- Companies with a net positive impact on people and/or the planet: we seek to invest in companies whose revenue-generating products or services contribute to one or more SDGs.

The fund’s binding elements are:

- The impact due diligence applies to all potential investments to ensure that the investment is aligned with the sustainable investment objective of the fund.

- Investee companies’ products and services must contribute to one or more SDG at the target level.

- Investee companies’ products and services must be impact-aligned or impact-generating (Norselab’s proprietary impact score >4).

- In addition, the fund applies the exclusions for EU Paris-aligned Benchmarks contained in Article 12(1)(a)-(g) of Commission Delegated Regulation (EU) 2020/1818.

All potential investee companies undergo impact due diligence to uncover operational sustainability risks, including good governance. The Investment Manager monitors portfolio companies’ good governance practices regularly through Board participation and dialogues with the companies’ management. This includes assessing the companies’ management structures, employee relations, remuneration policies, and tax compliance. If risks related to good governance are identified, the Investment Agreement may include concrete improvements to be implemented. Such improvements are followed up through active engagement with companies.

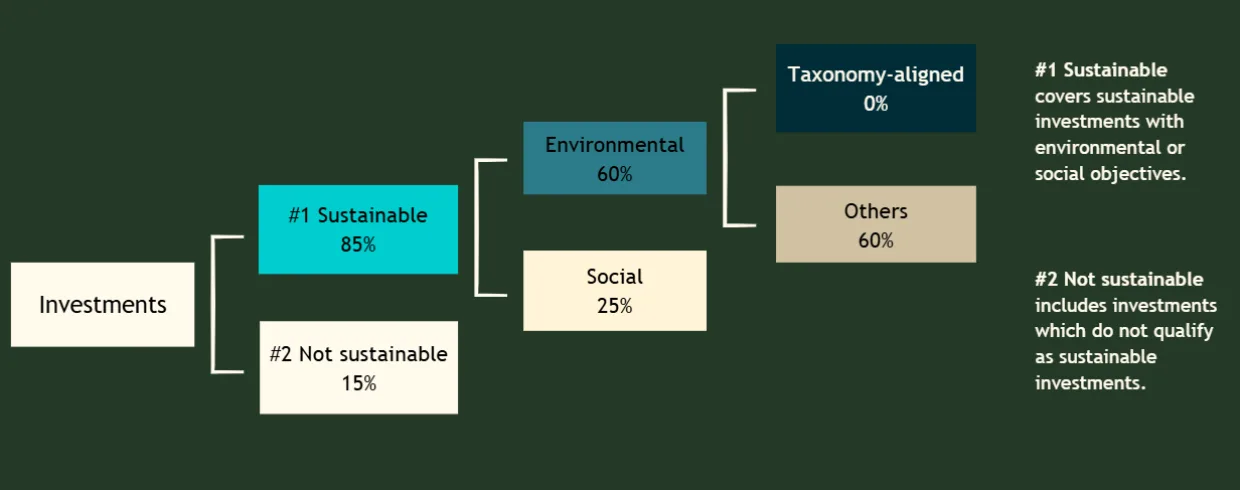

Proportion of investments

The fund intends to make a minimum of 85% of investments (“#1 Sustainable” in the illustration below). The fund seeks to invest in companies that generate a net positive contribution, through their core products and services, to the UN Sustainable Development Goals. Specifically, the portfolio company’s products and services must contribute to one or more SDGs at target level and cannot have a significant negative impact on any of the SDGs.

The fund does not invest in fossil gas and/or nuclear energy-related activities that comply with the EU Taxonomy.

As an Alternative Investment Fund (AIF), the fund may hold cash from time to time. Under the SFDR, cash is not considered a sustainable investment. Up to 15% of the fund is cash balances and is therefore not intended for sustainable investments (“#2 Not sustainable” in the illustration below).

Monitoring of sustainable investment objective

The fund will monitor and report on the following indicators:

- % of investments contributing to the SDGs

- Aggregated SDG-based net impact (based on data modeled by the Upright Project)

- % of investments that are eligible under the EU’s Taxonomy Regulation

- % of impact-generating investments (as defined by Norselab’s proprietary impact framework)

- % of impact-aligned investments (as defined by Norselab’s proprietary impact framework)

All indicators are weighted based on the physical holdings of the fund (cash excluded).

The Investment Manager’s independent Product Governance Committee conducts ex-ante reviews of all the fund’s investments to ensure compliance with the fund mandate and Norselab’s policies.

Companies report to Norselab on impact-related metrics. Furthermore, we monitor companies regularly through Board participation and dialogues with the company’s management. Specifically:

- As an owner, we work proactively with portfolio companies to promote strategies aligned with the SDGs and implement relevant measuring and reporting schemes for impact.

- We track Principal Adverse Impact indicators quarterly.

- We track good governance practices, including companies’ management structures, employee relations, remuneration policies, and tax compliance.

In addition, the Investment Manager’s impact team carries out an annual review and update of all portfolio impact assessments to account for all developments that might have an effect on the company’s impact potential.

Methodologies

Norselab’s Meaningfulness Policy describes our overarching impact philosophy and approach. It guides how Norselab identifies and measures impacts and risks.

We define impact as a significant contribution to achieving the SDGs. They provide a comprehensive map of risk and opportunity - and thus, a solid strategic prism through which we can meaningfully and successfully invest in new, growing, and established companies through Norselab’s various funds.

To ensure a solid foundation for investment decisions, our approach aims to build the most complete picture of a company’s current and potential, positive and negative impacts. This means using multiple lenses in our assessments of companies. To date, our approach consists of the following lenses:

- Fundamental research: Our team of sustainability specialists performs fundamental research based on available peer-reviewed academic and industry research to document the potential impact thesis of assessed companies.

- SDGs: The contributions of companies’ products and services are mapped to the underlying targets and indicators of the SDGs. We consider both positive and negative contributions. For positive impact, only concrete and substantial contributions are taken into account.

- Net impact quantification: We quantify both positive and negative impacts of companies’ products and services to provide a net impact score.

- EU regulatory assessments: We screen and assess companies based on the Principal Adverse Impact indicators defined by the SFDR, assess compliance on good governance principles, and perform assessments for potential eligibility and alignment with the EU Taxonomy.

- Operational risk assessments: We seek to uncover operational risks and strengths, to ensure that companies operate responsibly and sustainably. This includes mapping potential gaps to fill.

Our assessment culminates in a scorecard where we distinguish between two types of companies that fit with our fund’s mandates: impact-aligned and impact-generating investments.

As of today, these lenses provide satisfactory insights into a company’s impacts and risks. We are, however, constantly considering adding new data layers that could enhance our approach and hence our understanding of companies’ impacts from various perspectives.

The Investment Manager publishes, on an annual basis, an Impact Report, which provides open access to key methodologies.

Data sources and processing

The Investment Manager’s impact team uses multiple information sources through the due diligence process (the due diligence process for the fund is described below under “Due Diligence”):

- To carry out fundamental research, assess compliance with good governance and contribution to the SDGs, we use company information and insights, peer-reviewed and industry research, as well as external sources on the products and services’ impacts.

- For the SDG-based net-positive impact, we use data modeled by the Upright Project, a third-party impact data provider. The Upright Project quantifies the net impact of products and services, considering their upstream and downstream value chains.

- For sustainability risks and Principal Adverse Impact indicators, we use company information and insights, and data modeled by the Upright Project.

We use one third-party data source in our assessment: the Upright Project. The SDG-based net-positive impact and the Principal Adverse Impact indicators are mainly modeled and estimated by the Upright Project, when company-reported data is not available However, some of the Principal Adverse Impact indicators are reported directly to the fund by the portfolio companies. We will clearly state what is estimated data in the Statement on Principal Adverse Impacts of Investment Decisions on Sustainability Factors.

Our in-house specialists review data provided by third parties. Data regarding net-positive impact and PAI indicators is downloaded and stored internally at least annually. We continuously seek to enhance our data processes and explore automation that may enhance precision and minimize operational risk.

All third-party data providers, including the Upright Project, have been chosen based on a data provider review. We carry out reviews of and engage with our third-party data providers regularly. Key quality criteria we look at in our reviews include data coverage, transparency of data source (e.g., how an estimation has been calculated, company-reported data), and data metrics provided.

Limitations to methodologies and data

Due to the size of the companies the fund seeks to invest in, an important limitation is the availability of information and data.

As with most data sources, the data modeled by the Upright Project has some inherent limitations. Due to the limited availability of underlying information and the nature of the indicators, the produced information intrinsically includes some inaccuracy. The Upright Project continuously seeks to improve the accuracy of its indicators by using the best available information and the best available statistical methods for integrating information from different sources. The Upright Project does not warrant the accuracy of the information, and shall not be liable for any direct or indirect damages related to the information it provides. The information provided in our reporting is reproduced with permission from the Upright Project, and may not be redistributed without permission from the Upright Project.

We will continue to engage with third-party data providers to improve the quality of the estimated data.

To address such limitations and to build the most complete picture of a company’s positive and negative impacts, we use a multi-lens approach to our investment decisions, as described under “Methodologies”.

Due diligence

To understand the impact of each investment, we apply a multi-lens approach throughout the investment due diligence process. This is carried out by a team of sustainability professionals (within the Investment Manager but independent of the portfolio management team) who conduct due diligence on the potential investment. The team assesses and documents the following:

- Impact thesis: Companies’ products or services have a clear impact theory of change, meaning a company must have a clear and scientifically supported articulation of the sustainability challenge(s) it contributes to solving, and a concrete explanation of how a product or service is expected to produce the desired impact.

- Contribution to SDGs: Companies’ products or services contribute at a substantial and concrete level to the achievement of at least one SDG, as defined at the target level of the SDGs. Products or services with a significant negative impact on any of the SDGs, or that cause significant harm to any environmental or socially sustainable investment objective, are excluded.

- SDG-based net positive impact: Companies’ products or services have a net positive impact mapped to SDGs based on data modeled by the Upright Project. The Upright project quantifies the net impact of products and services, considering their upstream and downstream value chains.

- Sustainability risks: Companies do not cause significant sustainability risks and Principal Adverse Impacts benchmarked against industry peers. In any event, if significant harm is uncovered in the assessment of the Principal Adverse Impacts indicators of a company, the company is excluded from investment.

Our assessment culminates in a scorecard where we distinguish between two types of companies that fit with our fund’s mandates: impact-aligned and impact-generating investments.

Engagement policies

We believe that we have the responsibility to use all available levers to contribute to change. Dialogue and engagement is an opportunity to create awareness and influence companies to increase their consideration of sustainability, and one of the tools that we have to drive concrete change in individual companies.

When we invest in a company, we already know that it is a solid impact case based on the impact due diligence. However, it is our role as investors and active owners to help companies enhance and deepen their impact. This work starts already before we invest. As we perform our impact due diligence, we aim to identify possible areas where the company could increase its positive contributions. When looking at a company’s operational aspects, we also uncover potential discrepancies and make recommendations for policies, strategies, and processes to implement in the field of sustainability.

After we invest, we put our resources at the disposal of our portfolio companies to keep them up to date on sustainability-related trends and regulations and help them produce the documentation they need for reporting and/or fundraising purposes. At the demand of companies, we can also be hands-on resources in strategic projects where sustainability is core. Where relevant, we encourage portfolio companies to hire professionals with solid sustainability competence into key positions.

Attainment of the sustainable investment objective

The fund does not use a designated index to reference benchmark its investments.