Sustainability-related disclosures

Norselab Financial Hybrid

LEI: 635400AFKDDDPFPPF887

Download Website Sustainability-related Product Disclosure

Download Pre-Contractual Disclosure

Summary

This document aims to provide information on the environmental and social characteristics of Norselab Financial Hybrid (“the fund”), and how these are promoted. The fund aims to contribute to enhancing understanding and awareness of the imperative to transition away from products and services that harm the UN SDGs, while continuing to emphasize that sufficient and credible measures to improve social and environmental sustainability in operations are expected. The fund aligns with Norselab’s governing policy on sustainability across investment activities, the “Meaningfulness Policy.” We follow a structured assessment process in line with the fund’s promoted environmental and social characteristics.

No sustainable investment objective

This financial product promotes environmental or social characteristics but does not have sustainable investments as its objective.

Environmental or social characteristics of the financial product

The fund promotes the following environmental and social characteristics as part of the investment strategy:

- Transitioning away from products and services causing harm to the UN Sustainable Development Goals (the 'UN SDGs').

- Climate change mitigation in issuers’ operations.

- Achieving an overall net positive impact from the investment strategy.

The promoted environmental and social characteristics contribute to enhancing understanding and awareness of the imperative to transition away from products and services that harm the UN SDGs, while continuing to emphasize that sufficient and credible measures to improve social and environmental sustainability in operations are expected.

Investment strategy

The fund’s investment objective is to achieve an attractive level of total return (income plus capital appreciation) through investments in bonds classified as supplementary capital or hybrid capital, issued primarily by banks, insurance companies, and financial institutions, integrating impact and sustainability considerations into investment decisions.

The fund will aim to achieve its objective by predominantly investing in hybrid capital and supplementary capital securities. Such securities form the potential investment universe, which the Investment Manager further assesses to identify investments that promote the environmental and social characteristics defined above, namely, where issuers qualify, at a minimum, as “Neutral” in the Investment Manager’s proprietary impact assessment framework. Qualify as “Neutral” issuers:

- Whose core products and services do not cause significant harm to the UN SDGs. Some issuers may additionally have a positive contribution to the UN SDGs through their products and services, but such contributions are expected to be of limited significance.

- That demonstrate sufficient and credible mitigating efforts on material sustainability topics in operations, if applicable.

- That pass the Investment Manager’s systematic Do No Significant Harm and good governance screening and assessment.

The Investment Manager’s dedicated impact team will perform the analysis of issuers’ environmental and social characteristics in a structured manner (see later sections for a breakdown of the assessment process).

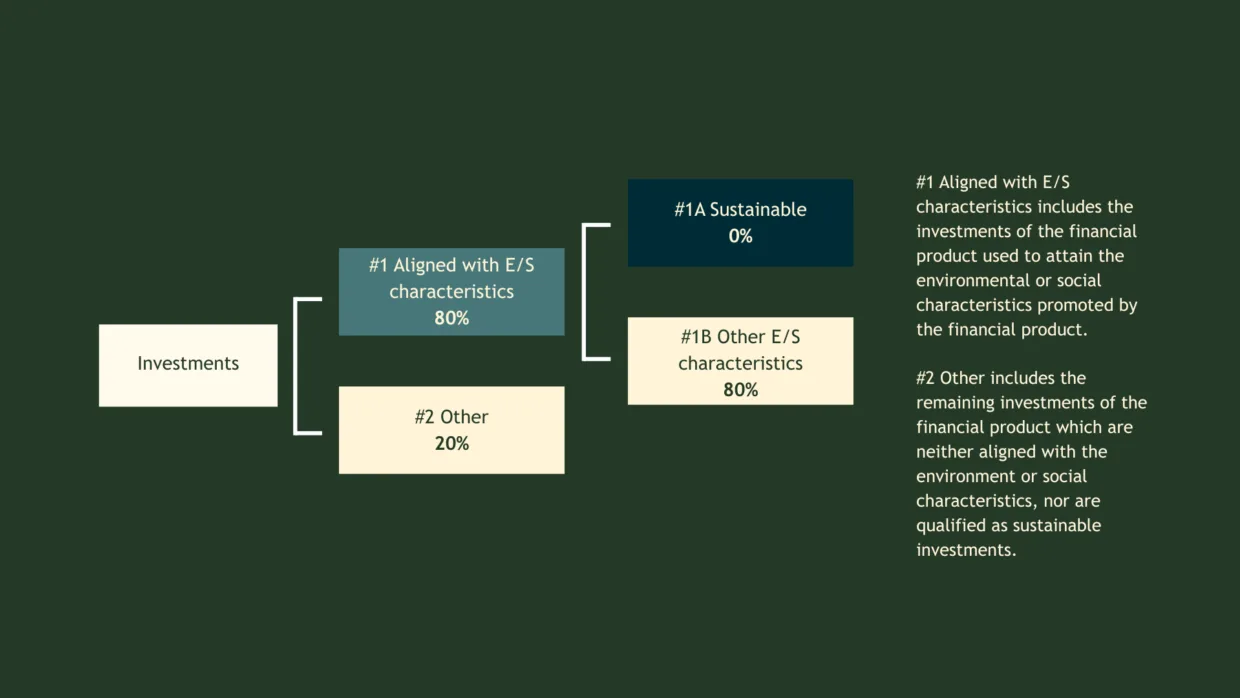

Proportion of investments

The fund intends to invest minimum 80% of the capital in issuers that promote the environmental and social characteristics mentioned previously.

Up to 20% of the fund will not align with the environmental and social characteristics promoted by the fund, referred to as “Other.” These are the fund’s cash balances and derivatives. Derivatives will not be used to attain the environmental or social characteristics the fund promotes but will mainly be used for hedging purposes.

In rare exceptions, the fund may use derivatives for portfolio exposure. In such cases, the same thorough assessment process described above applies to attain the environmental and social characteristics that the fund promotes.

Monitoring of environmental or social characteristics

The fund’s binding elements are:

- Issuers qualify, at a minimum, as “Neutral” in the Investment Manager’s proprietary impact assessment framework and scorecard (as described above).

- No significant harm to any of the SDGs from any investment. A fund-level net positive impact score, as measured by a third-party data provider. The score expresses the fund’s positive impacts, net of negative impacts, aggregating the score of the issuers in its portfolio.

As such, the fund will monitor and report on the following indicators:

- Share of investments with a score of 3/5 (“neutral impact”) or above, as defined in the Investment Manager’s proprietary impact assessment framework and scorecard. Weighting is based on the physical holdings of the fund (cash excluded).

- Occurrence of significant harm to the UN SDGs from investments in the applicable period.

- Share of portfolio with Science-Based Targets covering Scopes 1, 2, and 3. Weighted based on the physical holdings of the fund (cash excluded).

- Fund-level net impact score, as modeled by a third-party data provider. This score expresses the fund’s positive impacts, net of negative impacts, aggregating the score of the issuers in its portfolio.

The Investment Manager’s independent Product Governance Committee conducts ex-ante and ex-post reviews of all the fund’s investments to ensure compliance with the fund mandate and Norselab’s policies.

The indicators are regularly monitored using third-party data, as well as through our own continuous assessments and monitoring. We report to investors on some of these indicators on a monthly basis.

Methodologies for environmental or social characteristics

Norselab’s Meaningfulness Policy describes our overarching impact philosophy and approach. It guides how Norselab identifies and measures impacts and risks.

To ensure a solid foundation for investment decisions, our approach aims to build a complete picture of a company’s potential or current negative impacts, and actions put in place to remediate these. This means using multiple lenses in our assessments of companies. To date, our approach consists of the following lenses:

- Fundamental research: Our team of sustainability specialists performs fundamental research based on available independent industry research from recognized organizations, as well as other external sources on the impacts of products and services, to document where the risk of potential harm lies for the type of financial institutions the fund seeks to invest in.

- SDGs: The potential negative contribution of financial institutions’ products and services are mapped to the underlying targets and indicators of the SDGs, as a lens to assessing their alignment with a sustainable future. This mapping is used to search for significant harm and/or any existing mitigating efforts.

- Net impact quantification: We quantify both positive and negative impacts of companies’ products and services to provide a net impact score.

- EU regulatory assessments:

- We screen and assess companies based on the Principal Adverse Impact indicators defined by the SFDR.

- We assess compliance with good governance principles, which include assessing at a minimum: 1) Management structures, 2) Employee relations, 3) Remuneration policies, and 4) Tax compliance.

- Operational risk assessments: We seek to uncover operational risks and strengths, to ensure that companies operate responsibly and sustainably.

We will constantly consider adding new data layers that could enhance our approach and, hence, our understanding of companies’ impacts from various perspectives.

If any sustainability-related controversy arises, causing an investee company to fall out of the investible universe, they are no longer approved for new investment. The Investment Manager’s independent Product Governance Committee decides on adequate follow-up in such events.

The Investment Manager publishes a Principal Adverse Impact statement for the financial product by June 30th of every year. The statement includes a weighted average of the quarterly Principal Adverse Impact indicators provided by the aforementioned third-party data provider. The Investment Manager also publishes, on an annual basis, an impact report (“Meaningfulness Report”), which provides open access to key methodologies.

Data sources and processing

The Investment Manager’s impact team uses multiple data sources through the assessment process (the assessment process of the fund is described below under “Due Diligence”), including third-party data sources. Based on our multi-lens approach, we aim to build the most complete picture of a company’s impacts. This gives us a better understanding of the quality of the estimated data and of the data reported by the issuer itself. The following data, gathered during due diligence on an issuer, is used and stored in a Meaningfulness Memo:

- To carry out fundamental research on the industry and the products and services that typically cause harm to the SDGs, we use independent industry research from recognized organizations, as well as other external sources on the impacts of the products and services.

- We use company-reported information to investigate to what extent an issuer is involved in and/or transitioning away from these products and services and to assess whether its measures to improve social and environmental sustainability in operations are credible, particularly in relation to climate change mitigation. Company information typically includes annual reports (financial and sustainability or integrated), sustainability policies, any existing climate transition plans, and sector-specific transition plans, among other relevant documentation.

- To assess whether an issuer has a net-positive impact on the SDGs, we use data modeled by the Upright Project, a third-party impact data provider. The Upright Project quantifies the net impact of products and services, considering their upstream and downstream value chains.

- For good governance and Principal Adverse Impact indicators, we use company information and insights where available, and data modeled by third-party data providers. We also rely on MSCI ESG Manager and the general media to uncover any governance-related controversies.

To ensure the veracity of company-reported data, we look for indicators such as third-party audits of sustainability reports, targets calculated using recognized standards such as the GHG Protocol standards, aligning with the Paris Agreement goals, and validated by organizations such as the SBTi.

Most data from third parties is estimated, except where the issuer has reported data. The SDG-based net-positive impact and the Principal Adverse Impact Indicators are mainly modeled and estimated by the Upright Project, when company-reported data is not available. Data on companies’ involvement in ESG-related controversies and incidents is sourced from MSCI based on alleged involvement in adverse impact activities as reported by the media, nongovernmental organizations (NGOs), civil society groups, academia, regulators and other stakeholders.

Our in-house specialists review data provided by third parties. Data regarding net-positive impact and PAI indicators is downloaded and stored internally at least annually. We continuously seek to enhance our data processes and explore automation that may enhance precision and minimize operational risk.

All third-party data providers, including the Upright Project, have been chosen based on a data provider review. We regularly review and engage with our third-party data providers. Key quality criteria we look at in our reviews include data coverage, transparency of data source (e.g., how an estimation has been calculated, company-reported data), and data metrics provided.

Limitations to methodologies and data

An important limitation is the availability of information and data. Some issuers, such as niche banks, provide limited public information on their sustainability impacts, and estimations are not always available. However, when carrying out due diligence on issuers, we may engage with them and encourage them to share more information and data with us.

As with most data sources, the data modeled by the Upright Project has some inherent limitations. Due to the limited availability of underlying information and the nature of the indicators, the produced information intrinsically includes some inaccuracy. Upright Project continuously seeks to improve the accuracy of its indicators by using the best available information and the best available statistical methods for integrating information from different sources. Upright does not warrant the accuracy of the information, and shall not be liable for any direct or indirect damages related to the information it provides. The information in our reporting is reproduced by permission from Upright, and may not be redistributed without permission from Upright.

We will continue to engage with third-party data providers to improve the quality of the estimated data.

To address limitations and to build the most complete picture of a company’s positive and negative impacts, we use a multi-lens approach to our investment decisions, as described under “Methodologies for environmental or social characteristics”.

Another important limitation is the lack of precise data on the level of exposure of financial institutions to, among others, the conventional weapons and the oil & gas industries, through products they make available, such as pension funds that may be invested in such industries despite having published ethical guidelines and despite the fact that these products often disclose under SFDR Article 8. We acknowledge that a majority of financial institutions enabling their customers to invest their savings and pensions in such products will have an exposure to these industries to realize the promised returns.

Due diligence

Issuers in the fund’s potential investment universe are screened and assessed to identify investments promoting environmental and social characteristics and, in particular, issuers that qualify at a minimum as “Neutral” in the Investment Manager’s proprietary impact assessment framework. A limited number of issuers may also demonstrate more substantial positive contributions to the UN SDGs, in line with the “Impact Aligned” category in the aforementioned framework.

The Investment Manager’s dedicated impact team will perform the assessment of issuers’ environmental and social characteristics in a structured manner. The assessment will, at a minimum, include screening for:

- UNGC compliance: The issuers will be screened on UN Global Compact compliance through MSCI. Issuers that do not comply may be excluded from consideration.

- Compliance with exclusion factors: Issuers with ties to industries with lasting negative impacts on one or more SDGs, as uncovered by MSCI or through our own assessment, may be excluded from consideration. The criteria include less than 5% exposure to weapons, tobacco, or gambling.

- Impacts on UN SDGs: Reviewing the issuers’ products and services to identify potential positive contributions and potential significant harm to the UN SDGs. The assessment pays particular attention to issuers’ potential financed harm to the SDGs. In any case, if significant harm to the SDGs is uncovered, the issuer is excluded from the universe.

- Net positive impact: Modeling the issuer’s net impact with assistance from a third-party data provider.

- SFDR: Considering Do No Significant Harm through products and services as well as through operations, including evaluating the issuers’ efforts to improve operational sustainability. Issuers that demonstrate significant harm through their Principal Adverse Impact indicators or governance practices may be excluded from consideration.

This due diligence is carried out by a team of sustainability professionals (within the Investment Manager but independently of the portfolio management team) who conduct product-level and issuer-level assessments based on multiple data sources (see “Data sources and processing”).

The Investment Manager’s independent Product Governance Committee conducts ex-ante and ex-post reviews of all the fund’s investments to ensure compliance with the fund mandate and Norselab’s policies.

Engagement policies

We believe that we have the responsibility to use all levers to contribute to change. Dialogue and engagement are an opportunity to create awareness and influence companies to consider sustainability more. They are also one of the tools that we have to drive concrete change in individual companies.

As we perform our impact due diligence, we may identify areas where the company could deploy additional efforts to mitigate potential negative impacts from its products and services and/or operations, in particular in the case of smaller issuers such as niche banks. Where possible to establish a direct contact, we may suggest actions to increase transparency and improve documentation regarding their impact and operations.

We continuously strive to enhance our engagement process.

Designated reference benchmark

The fund does not use a designated index to reference benchmark its investments.