ESG is in for an overhaul. It’s time to do good, not less bad.

What’s ahead for sustainable investing?

Dark skies are looming over ESG and the USD 2.7 trn sustainable investing world. It’s been the talk of the town these past few months: are so-called “green” or “sustainable” investments not all they’re made up to be?

Some of the biggest names in finance, including DWS Deutsche Bank, BNY Mellon, and Goldman Sachs, have been tainted by allegations of “greenwashing” and “ESG fraud”. As the confusion grows blatant, industry insiders are spilling their beans, and regulators are stepping up to investigate. What’s up with sustainable investing and ESG?

“Sustainable investing” is currently the fastest-growing segment in the investment industry, with a 53% growth year on year. Market-size estimates range from Bloomberg’s optimistic USD 41trn to the more robust Morningstar estimate of USD 2.7 trn. When people talk about “sustainable investing”, however, it may be any kind of investment strategy related to sustainability. It has become a catch-all term, and it’s often used synonymously with ESG investing or impact investing. Its meaning depends on who you ask, what you measure, and how you define sustainability.

Why is the sustainable investing space so bewildering, and what can investors do to cut through the noise?

The ESG conundrum

Environmental, social and governance (ESG) data are at the heart of the confusion. Investors use data from ESG data providers when labeling their investments “ESG aligned”, “sustainable”, or “green”, but we have good reason to question both the quality and the relevance of the data they use.

A staggering 18 million data points have been generated by ESG data providers. Metrics related to issues such as carbon emissions and labor rights are frequently measured, but the underlying methodology differs from one data provider to another. In addition, 60% of ESG data points are policy-based. This means that they are mainly box-ticking exercises focusing on what companies say they do, rather than the results they create.

ESG data also focus mainly on a company’s operations - how well the company is run - rather than on the products they sell and the impact of the product throughout the value chain. This is why a fossil fuel company can get a good ESG rating, while an electric car producer that falls short on social and governance aspects may not necessarily be well rated.

The great perception gap

The number of “sustainable” funds is increasing; according to Morningstar, we now count about 4500 such funds, of which around 1200 new in 2021. Over 500 of these, however, were rebranded from traditional funds to “sustainable” funds. Does this mean that the investment world is truly embracing the opportunity of doing good for people and the planet, or is it just a massive greenwashing exercise?

Although ESG ratings are legitimately being questioned, financial market players carry the responsibility for how they market their products. Everyone who has labeled their financial products “sustainable” based on ESG ratings has sown the seeds of what I call “the perception gap”; There is a significant difference between what people have been led to believe ESG is, and what it really is.

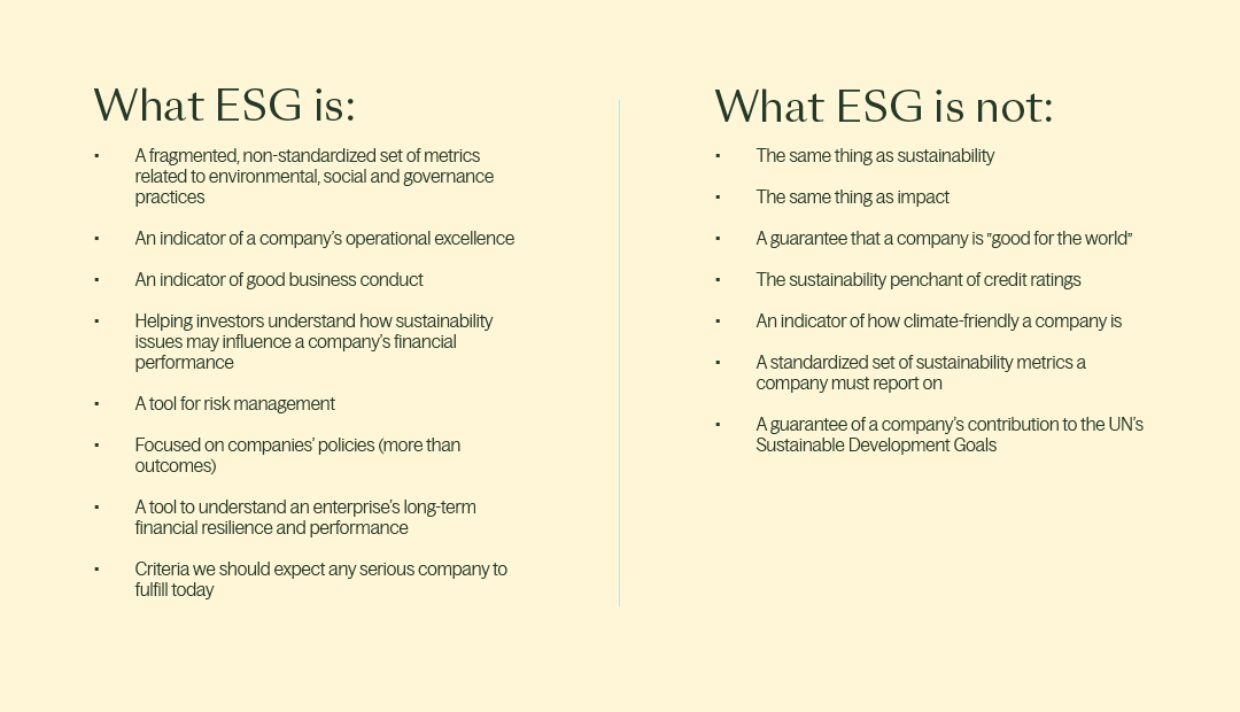

Let’s get something out of the way right now: ESG is not the same thing as sustainability. Nor is it the same thing as impact. Most investing professionals will know that ESG is generally used to uncover sustainability-related risks and opportunities that could affect a company financially. On the other hand, impact considers how a company affects the world. Two very different perspectives.

The sustainable investing spectrum is broad and catches these different perspectives (see figure below). The spectrum ranges from “ESG-screened”, which is about excluding “bad” industries and considering operational risks, to “Impact-generating”, which is about driving positive change for people and the planet alongside financial returns. Philanthropy also focuses on positive impact, but does not require financial returns, and is therefore kept apart in the spectrum. Asset managers must offer clarity on where in the spectrum their financial products belong, and be transparent on how they ensure that they deliver on their promises.

It’s about building must-have companies

For the past twenty years, “sustainable investing” has largely failed to consider the broader effects of companies. We have been raised to believe that operational excellence (as measured by ESG ratings) is enough. But when it comes to building a sustainable future, we need to think differently; rather than investing based on how well companies operate, it’s time we invest in companies that do the right thing.

Considering the gravity of the issues our world faces, we need to grow a generation of companies that tackle our most significant issues and help drive systemic change. We need companies that are intrinsically good for the world. Investors that want to fuel the change should focus on companies’ core products and the impacts that they create, both upstream and downstream.

When focusing on the positive impact of companies’ products - versus mainly considering how the company operates - we can invest in companies where sustainability is embedded at the core of the business. We create an intrinsic tie between a company’s commercial success and the scale of its positive impacts. Let’s say we invest in a company that has built an all-new technology for producing clean, local energy from wastewater, manure, food scraps, and other types of organic waste. Through their core product offering - a scalable, modular and affordable digester tank - they enable industry players and local communities to get rid of their organic waste while accessing clean energy for fuel and electricity, alongside nutrient-rich biofertilizers for local farmers. To me, this is the beauty of product-driven impact: the world becomes a bit more sustainable with every new customer. As the company scales, it has the potential to create massive, positive impacts. (Disclaimer: this is the description of a company we invested in at Norselab).

Redefining sustainable investing

ESG is not designed to inform us about how well a company’s core business fits with a sustainable future - whether the company is intrinsically good for people and the planet.

This is the root of the mix-up. The problem is not that asset managers use ESG to consider risks and opportunities. The problem arises when they claim that their products are “sustainable”, “green” or “good for the world” based on ESG metrics alone. Then they are on very thin ice.

It’s about time we agree on the meaning of “sustainable investing”, and bring clarity to data providers, investors and consumers alike.

As ESG does not make the cut for sustainability, what’s ahead for “sustainable investing”? There is no silver bullet, but here are some principles I would like to see more asset managers adopt.

- If you want to make an impact, focus on the company’s revenue-generating products or services. If the company is making money off a product that is straight out bad for people and the planet, you have no business claiming it’s sustainable. You want positive impact and commercial success to be intrinsically tied; you do that by focusing on the company’s core product.

- Be clear on your definition of “sustainability”. If you want to credibly invest for a sustainable future, make the UN’s Sustainable Development Goals your compass. Show concretely how your portfolios contribute. Leave out the marginal stuff that you don’t have a strategy for pursuing.

- Account for both positive and negative impacts, throughout the value chain. No company exists in a vacuum; operational impacts alone do not tell the truth. Assessments should account for all effects of the company, both upstream and downstream.

- Apply a multi-lens approach. A single metric does not give the full picture. Although carbon emissions are the most urgent issue to address in the short term, sustainability is about more than carbon reduction. Strive to build a more comprehensive overview of a company’s impacts, using various tools and angles to understand which issue is more significant for the company in question.

- If you can’t prove it, don’t claim it. Go for radical integrity and transparency. Document all your claims. Disclose more than you have to. Never overpromise.

- Invest in sustainability competence. Sustainability is not black and white, it’s full of nuances and intricate interactions. Invest in an impact team with a single goal: produce solid and nuanced insights based on peer-reviewed research. And give them a seat at the decision-makers’ table.